In today’s digital age, WhatsApp has emerged as a ubiquitous messaging platform, seamlessly connecting billions of users worldwide. With the launch of WhatsApp Payments, the company has taken a bold step into the fintech arena, poised to disrupt the traditional financial landscape.

This innovative service allows users to send and receive money, make purchases, and manage their finances directly within the WhatsApp application, offering a convenient and user-friendly alternative to conventional payment methods.

Introduction

WhatsApp, the dominant messaging platform, has expanded its reach into the financial sector with the launch of WhatsApp Payments. This move has the potential to disrupt the fintech landscape and revolutionize the way people send and receive money.WhatsApp’s massive user base of over 2 billion active users presents a significant opportunity for the company to disrupt the traditional fintech market.

By leveraging its existing infrastructure and user base, WhatsApp Payments can offer a convenient, secure, and cost-effective alternative to traditional banking and money transfer services.

Impact on Traditional Payment Systems

WhatsApp Payments poses a significant challenge to traditional bank transfers and mobile wallets. Its seamless integration with WhatsApp’s vast user base and its user-friendly interface make it a compelling alternative for digital payments.Banks and other financial institutions face pressure to innovate and adapt to the changing landscape.

WhatsApp Payments’ low-cost and frictionless transactions could erode their market share, especially in emerging markets where mobile penetration is high.

Implications for Banks

* Reduced transaction fees: WhatsApp Payments charges minimal fees, making it more cost-effective for businesses and individuals.

Loss of market share

Banks may lose customers to WhatsApp Payments, particularly in segments where convenience and low cost are prioritized.

Need for innovation

Banks must invest in digital transformation to stay competitive, offering value-added services and seamless payment experiences.

Implications for Mobile Wallets

* Increased competition: WhatsApp Payments competes directly with mobile wallets, offering a similar range of services with a wider user base.

Loss of users

Mobile wallets may experience a decline in usage as WhatsApp Payments becomes more prevalent.

Need for differentiation

Mobile wallets need to differentiate themselves by providing unique features, loyalty programs, or specialized services.

Leveraging WhatsApp Payments for Businesses

Businesses are embracing WhatsApp Payments to streamline transactions and enhance customer engagement:* Faster payments: Customers can make payments directly through WhatsApp, eliminating delays associated with traditional methods.

Improved customer experience

Seamless payment integration enhances customer convenience and satisfaction.

Increased sales

Businesses can reach a wider audience and facilitate impulse purchases through WhatsApp Payments.

User Experience and Convenience

WhatsApp Payments boasts a user-friendly interface that seamlessly integrates with the WhatsApp messaging platform. The intuitive design enables users to send and receive payments effortlessly within their existing chat conversations. By eliminating the need for separate payment apps or complex processes, WhatsApp Payments significantly enhances the shopping experience for consumers.

Seamless Shopping Experience

WhatsApp Payments empowers consumers to make purchases directly from within the WhatsApp chat window. Businesses can create catalogs showcasing their products or services, allowing customers to browse and select items conveniently. The streamlined checkout process enables users to complete transactions quickly and securely, without leaving the WhatsApp environment.

Case Study: Enhanced Shopping Convenience

A recent survey conducted by WhatsApp revealed that over 80% of users found WhatsApp Payments to be more convenient than traditional payment methods. One user, a small business owner, shared her experience: “WhatsApp Payments has revolutionized the way I manage my business.

Customers can now order and pay directly through WhatsApp, making it much easier and faster for them to make purchases.”

Security and Privacy Concerns

WhatsApp Payments prioritizes the security of user data and transactions. It employs multiple layers of encryption to safeguard sensitive information, including:

End-to-end encryption

All messages, including payment requests and notifications, are encrypted from sender to receiver, ensuring privacy.

Two-factor authentication

Users can enable two-factor authentication to add an extra layer of protection, requiring a verification code for login and transactions.

Data minimization

WhatsApp collects only the information necessary for payment processing, minimizing the risk of data breaches.

Privacy Implications

Linking financial information to a messaging platform raises privacy concerns. WhatsApp assures users that their payment data is separate from their messaging data and is not shared with third parties. However, it’s essential to be aware of the potential risks:

Data sharing

While WhatsApp claims not to share financial data, it’s possible that government agencies or law enforcement may request access to user information.

Targeted advertising

WhatsApp may use payment data to target users with relevant ads or promotions.

Recommendations for Users

To mitigate potential risks, users should consider the following recommendations:

- Enable two-factor authentication for enhanced security.

- Review WhatsApp’s privacy policy to understand how your data is handled.

- Use strong passwords and avoid sharing them with others.

- Be cautious of suspicious messages or requests for financial information.

- Monitor your payment activity regularly for any unauthorized transactions.

Market Expansion and Global Impact

WhatsApp’s immense global reach and user base position it as a potential disruptor in the fintech industry, particularly in emerging markets where traditional financial services may be limited. Its platform provides a convenient and accessible way for individuals to send and receive payments, potentially bridging the gap in financial inclusion.

Challenges and Opportunities in Different Regions

WhatsApp Payments faces various challenges and opportunities as it expands into different regions. In developed markets, it competes with established payment providers, while in emerging markets, it must address issues such as low smartphone penetration and limited internet access. However, WhatsApp’s large user base and familiarity in many regions present significant opportunities for growth.

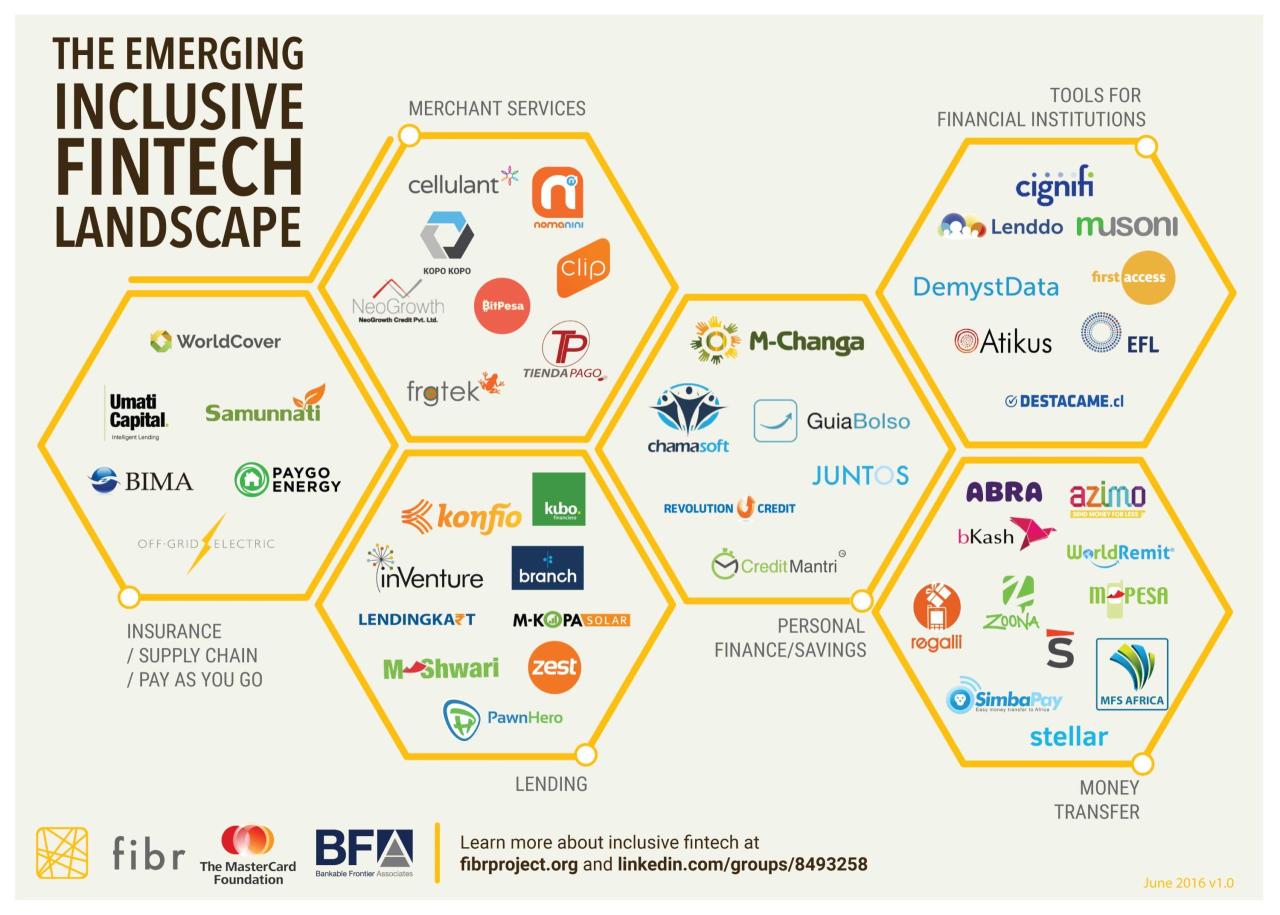

Competitive Landscape and Market Expansion Strategies

WhatsApp competes with a range of players in the fintech landscape, including mobile payment providers, banks, and financial institutions. To expand its market share, WhatsApp has adopted strategies such as partnerships with local financial institutions, integration with existing payment systems, and targeted marketing campaigns.

By leveraging its user base and strategic collaborations, WhatsApp aims to establish a strong foothold in both developed and emerging markets.

Future Outlook and Innovations

WhatsApp Payments has established itself as a formidable player in the fintech industry, and its future holds even greater potential for innovation. The platform is poised to leverage emerging trends and introduce novel features that will further enhance its payment services.

Expanding into New Markets

WhatsApp Payments has already made significant inroads into emerging markets, where it has become a primary payment method for millions of users. The platform’s continued expansion into these markets will provide it with a vast pool of new customers and drive further growth.

Outcome Summary

As WhatsApp Payments continues to expand its global reach, it has the potential to reshape the fintech industry, empowering individuals and businesses alike. Its user-centric approach, combined with the vast network of WhatsApp users, positions it as a formidable force in the digital payments ecosystem.

The future of WhatsApp Payments is brimming with possibilities, and it will be fascinating to witness its continued evolution and impact on the fintech landscape.

FAQ Corner

How does WhatsApp Payments ensure the security of user data and transactions?

WhatsApp Payments employs robust security measures, including end-to-end encryption, multi-factor authentication, and fraud detection systems, to safeguard user data and protect transactions from unauthorized access.

What are the privacy implications of linking financial information to a messaging platform?

WhatsApp Payments adheres to strict data protection regulations and provides users with transparent privacy policies. Users have control over their financial information and can choose to share it only with trusted contacts or businesses.

How is WhatsApp Payments challenging traditional bank transfers and mobile wallets?

WhatsApp Payments offers a seamless and convenient alternative to traditional bank transfers and mobile wallets. Its integration with WhatsApp’s vast user base and user-friendly interface make it an attractive option for individuals and businesses seeking a hassle-free payment experience.